The transition of global automaker General Motors Company (GM) to electric cars (EVs) does not seem very smooth. The corporation is facing issues in its drive to either win or maintain market share in the automotive industry.

Shares of the company were down 7% over the five days, while it gained 71% over the past year. This author's sentiment on this stock is neutral.

Underlying Problem for GM

General Motors has announced a voluntary recall for its Chevrolet Bolt EVs. On Friday, the company recalled over 73,000 EVs, including 9,335 Bolt EVs (2019 models) and 63,683 Chevrolet Bolt EVs and EUVs (2020–2022 models).

The company announced the recall as a precautionary step. According to management, some batteries may have production flaws, increasing the risk of fire. Keeping the safety of its users as a top priority, the company will replace the old battery modules with new ones.

In terms of money, the company anticipates an additional expenditure of around $1 billion to manage the fire risks. However, General Motors expects to be reimbursed by LG, because the battery cells were manufactured at that company's facility.

This is the third recall announcement in a row for GM. The first recall was issued in November 2020, followed by the second in July of this year. Both recalls were issued due to fire safety concerns.

Following the latest recall announcement on Friday, shares were down approximately 2% in the after-hours trading.

Other Factors Worth Considering

The global vehicle manufacturing firm reported strong financial results for the second quarter of 2021. The quarterly revenue jumped 103.6% to $34.2 billion, higher than analysts’ expectations of $29.11 billion. Also, adjusted earnings per share came in at $1.97, outpacing the Street’s estimate of $1.89.

Furthermore, for 2021, the company expects adjusted EPS to be in the range of $5.40 and $6.40.

However, Jefferies analyst Philippe Houchois remained unimpressed with the company’s earnings announcement. Likewise, many investors were unimpressed by the soft earnings guidance provided by management.

Houchois reiterated a Hold rating on the stock, but decreased the price target to $53.00 from $68.00. This implies 8.6% upside potential to current levels.

According to the analyst, GM's EV transition plan is no longer superior to that of its competitors. Furthermore, he believes that GM's 2022 product launch plan is unappealing.

What is Wall Street’s Take on it?

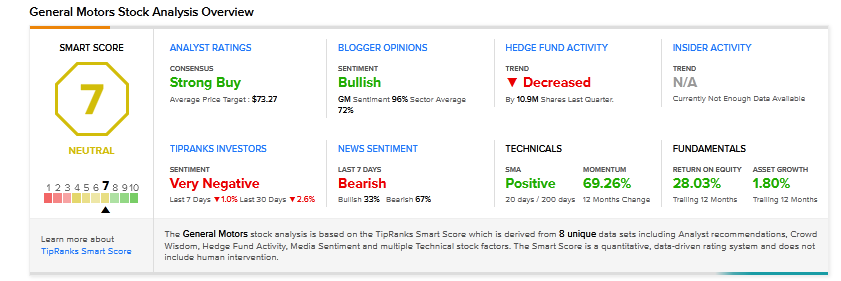

Despite a string of vehicle recalls and related safety risks, GM stock commands a Strong Buy consensus rating based on 14 Buys and 1 Hold. The average General Motors price target of $73.27 implies 50.1% upside potential to current levels.

On August 12, RBC Capital analyst Joseph Spak reiterated a Buy rating on the stock with a price target of $75 (53.7% upside potential).

Despite some volatility in the near term, Spak believes the climate will improve sequentially into 4Q21. In addition, the analyst claimed that management is taking measures to avoid any future "supply crunch."

Bottom Line

The electric vehicle market has witnessed substantial growth in recent years, and General Motors is taking advantage of the trend by investing heavily in electric vehicles. However, success does not come easily, and GM is not immune to problems.

Given the fundamental issues weighing on the firm, such as regular EV recalls, a modest outlook, and ambiguity surrounding GM's future plans, investors might choose to remain on the sidelines for the time being.

A two-day investor event set for Oct. 6-7, however, could shed more light on a variety of topics, including vehicle launches planned for 2021 and 2022, progress on battery and fuel cell technology, and other activities relating to its driver-assistance technology.

Moreover, the stock’s TipRanks SmartScore, which comprises 8 unique data sets, indicates that the stock is likely to perform in line with market averages.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.

The post Could Recalls Put the Brakes on General Motors? appeared first on TipRanks Financial Blog.

-----------------------------

By: Shalu Saraf

Title: Could Recalls Put the Brakes on General Motors?

Sourced From: blog.tipranks.com/could-recalls-put-the-brakes-on-general-motors/

Published Date: Mon, 23 Aug 2021 08:27:53 +0000

Read More

Make Money OnlineForexInvestingBitcoinVideosFinancePrivacy PolicyTerms And Conditions

Make Money OnlineForexInvestingBitcoinVideosFinancePrivacy PolicyTerms And Conditions